Selva Kumar, the newest addition to our content team at Loop Digital! Graduated with a BBA in International Marketing. Selva's journey into content writing and digital marketing began, fueled by his passion for storytelling, knack for keeping updated with the digital trends, and creating engaging content. Selva's commitment to delivering quality work shines through as he tries to be updated of digital trends to enhance his craft continually. With an eye for detail and a drive for excellence, he aims to surpass expectations with every project he undertakes. Beyond the digital realm, Selva is a budding novelist, weaving tales of wonder and imagination in his spare time. With his creativity and dedication, Selva is poised to make a significant impact in the world of content writing.

Posted on 03/09/2025 by Selva Kumar

Why EEAT is important for financial services

Read time: 12 minutes

If you’re running a financial services website in the UK, you’re playing in the big leagues whether you realise it or not. Success in search visibility increasingly depends on how well your site aligns with Google’s E-E-A-T standards. That’s why SEO for financial services in UK is no longer just about keywords and backlinks; it’s about building trust, demonstrating compliance, and proving authority online.

Every piece of content you publish, from mortgage guides to investment advice, has the potential to influence someone’s financial decisions.

That’s precisely why Google classifies financial content as YMYL (Your Money or Your Life) content, which means the quality bar is set significantly higher than for other industries.

Think about it: when someone searches for “best car finance deals in the UK” or “how to get small business finance with bad credit,” they’re not just looking for information; they’re making decisions that could affect their financial future for years to come.

Google recognises this responsibility and has developed increasingly sophisticated ways to evaluate whether financial content is helpful, reliable, and trustworthy.

This is where E-E-A-T comes in. Standing for Experience, Expertise, Authoritativeness, and Trustworthiness, E-E-A-T is Google’s framework for assessing content quality, and it’s absolutely crucial for financial services. It’s not just about ticking boxes for search engines; it’s about proving to your potential clients that you’re credible, knowledgeable, and worthy of their trust.

So, what does E-E-A-T mean for financial services, and why is it non-negotiable in today’s digital landscape? Let’s take a deeper look.

Table of Contents

- What is E-E-A-T?

- Understanding YMYL for Financial Services

- Why E-E-A-T is Non-Negotiable for Financial Services

- How to Implement E-E-A-T Across Your Financial Services Website

- In Summary

- Key Takeaways

- Ready to Make Trust a Ranking Advantage?

- Frequently Asked Questions

What is E-E-A-T?

Let’s start with the basics. E-E-A-T evolved from Google’s original E-A-T framework when “Experience” was added to Google’s search quality rater guidelines, reflecting Google’s recognition that first-hand experience often trumps theoretical knowledge alone.

(E for) Experience refers to the first-hand, practical knowledge that comes from actually doing something. In financial services, this might mean a mortgage broker sharing insights from helping hundreds of clients navigate the application process, complete with real-world examples of common pitfalls and how to avoid them.

(E for) Expertise is about having the right qualifications, knowledge, and skills for the topic at hand. For financial content, this means authors and reviewers should have relevant professional credentials, such as Chartered Financial Planners, FCA-qualified advisers, or economists with proven track records.

(A for) Authoritativeness focuses on your recognition within your field. Are you known and respected by peers, customers, and industry bodies? Do other credible websites reference your work? Authority isn’t just about what you say about yourself; it’s about what others say about you.

(T for) Trustworthiness is perhaps the most critical element for financial services. It encompasses transparency about fees and risks, clear contact information, robust complaints procedures, and a secure, professional website experience.Important Note: Quality raters don’t directly influence your rankings. Instead, they help Google evaluate whether search results are genuinely helpful to users. The guidelines they follow are essentially a blueprint for what Google’s algorithms are trying to achieve, and they’re incredibly useful for self-assessment.

Understanding YMYL for Financial Services

In the world of YMYL content, financial services cover a broad spectrum. Google considers the following as YMYL financial content:

- Investment advice and information (stocks, bonds, ISAs, pensions)

- Loan and credit products (mortgages, personal loans, credit cards)

- Insurance products and advice (life, home, car, travel insurance)

- Tax advice and information

- Banking services and information

- Retirement planning and pension advice

The reason YMYL content faces higher standards is straightforward: poor advice in these areas can lead to significant financial harm.

For example, someone following incorrect pension transfer advice could lose thousands in charges and benefits, while a misleading mortgage comparison might push a first-time buyer into unsuitable borrowing that locks them into unaffordable repayments for 25 years.

Google recognises this responsibility and expects financial websites to demonstrate clearly “who” created the content, “what” qualifications and experience they bring, and “for whom” the advice is most suitable.

For instance, an asset finance guide should state whether it was written by a qualified finance specialist, and a business loan article might include a reviewer note from an FCA-authorised adviser.

Your content should also explicitly show potential risks and limitations, such as. “This guide is for general information only and may not be suitable if you have complex tax considerations.”

From a user experience perspective, YMYL pages require clear contact routes, obvious business identity, and transparent ownership. Visitors should never have to search around your website to understand who’s behind the advice, how to reach you, or what safeguards are in place.

Why E-E-A-T is Non-Negotiable for Financial Services

In financial services, trust is the foundation of every client relationship. When someone is looking into options for vehicle finance, applying for asset finance, or even considering a business loan, they’re essentially asking: “Can I trust this company with my financial future?”

E-E-A-T signals help answer that question before prospects even pick up the phone.

Strong trust signals reduce friction in the customer journey and increase conversion rates. More importantly, they align perfectly with Google’s emphasis on helpful, reliable, people-first content.

How Google Search continues to improve results

In simple terms, would you rather check business loan options on a website with anonymous authors and no contact details, or from a site where a qualified finance specialist openly shares their credentials, provides clear contact information, and offers transparent examples of their work? The choice is obvious, and so is the business case for E-E-A-T.

This approach also aligns beautifully with the UK’s compliance culture. The FCA’s principle of treating customers fairly, ensuring communications are “fair, clear, and not misleading”, maps directly onto Google’s quality guidelines.

When you optimise for E-E-A-T, you’re simultaneously strengthening your compliance posture and reducing reputational risk.

How to Implement E-E-A-T Across Your Financial Services Website

Now that we understand what E-E-A-T looks like in theory, let’s get practical about implementation across different types of content and pages.

- Building Experience into Your Content

The best way to demonstrate experience is through specific, practical examples that only someone with genuine expertise could provide.

- Real-world case studies

Share anonymised examples of client situations you’ve helped resolve. For instance, “Recently, we helped a small construction firm struggling to secure asset finance due to limited trading history. Here’s how we structured their application…” This shows practical experience that generic advice articles simply can’t match.

- Process documentation

Create content that walks users through actual processes step-by-step. For example, document the journey from asset valuation and settlement figures to lender selection, document pack, and finally payout, including timelines, common challenges, and how you resolve them. This level of detail demonstrates genuine experience.

- Tools and calculators

Develop interactive tools based on your practical experience. For example, build an eligibility calculator for car finance that factors in vehicle price, deposit, term, mileage (for PCP), credit profile, trading history (for business users), and affordability checks, then return likely products (HP/PCP/lease), representative APR, and required documents.

- Regular updates with change logs

Financial regulations and market conditions change frequently. Show that you’re actively engaged by maintaining visible update logs: “Updated 20th September 2024: Added information about new FCA mortgage lending rules introduced in August 2024.”

Demonstrating Expertise

Expertise in financial services is often regulated and measurable, making it relatively straightforward to prove:

- Qualified content creators

Ensure every piece of substantial content is either written by or reviewed by appropriately qualified professionals. For example, your asset finance guide should be created or reviewed by an FCA-authorised business finance specialist, while your car finance or refinance content should be validated by advisers with proven experience in vehicle funding and compliance.

Comprehensive author bios

Don’t just list qualifications, tell the story. “Sarah Johnson CeFA has been helping UK families plan for retirement for over 12 years. She started her career at [respected firm], holds the Certificate for Financial Advisers qualification, and is a member of the Personal Finance Society. She specialises in pension transfers and has helped over 500 clients navigate the complexities of workplace pension schemes.”

Editorial standards

Develop and publish an editorial policy that outlines your commitment to accuracy, expert review processes, and source standards. This transparency builds trust and demonstrates a professional approach.

Strengthening Authority

Authority must be earned through consistent demonstration of expertise and recognition by others in your field:

Build genuine relationships with other professionals, trade bodies, and industry publications. This often leads to natural link opportunities, speaking engagements, and collaborative content.

Now and then, conduct surveys of your client base, analyse market trends from your unique perspective, or publish insights based on your professional experience. Original data and analysis that others find valuable naturally builds authority.

Furthermore, pursue relevant awards, accreditations, and professional body memberships. While these shouldn’t be the primary focus, they provide valuable third-party validation of your expertise.

Enhancing Trustworthiness

Trustworthiness in financial services goes far beyond just having an SSL certificate:

Be upfront about everything that matters to customers. If you’re an IFA, clearly explain your fee structure, what services are included, and what additional costs might arise. If you’re a lender, make APRs, eligibility criteria, and representative examples prominent and easy to understand.

Provide multiple contact methods and be responsive. Consider live chat for complex queries, comprehensive FAQ sections, and clear escalation procedures. Make it genuinely easy for customers to get help when they need it.

Encourage genuine reviews and respond thoughtfully to all feedback, especially negative comments. This shows you take customer satisfaction seriously and are committed to continuous improvement.

In Summary

For UK firms, SEO for financial services goes hand in hand with building strong E-E-A-T signals. When your SEO strategy is aligned with both FCA standards and Google’s quality guidelines, your business can compete more effectively in search and build lasting trust with clients.

They’re essential for both regulatory compliance and search success. E-E-A-T provides a framework for demonstrating these qualities in ways that both search engines and potential clients can recognise and value.

The key insight is that E-E-A-T isn’t about gaming search algorithms; it’s about building the kind of authoritative, trustworthy online presence that successful financial services businesses need anyway. When you implement E-E-A-T properly, you’re not just improving search rankings; you’re building a stronger business foundation that supports better customer relationships, reduced compliance risk, and improved conversion rates.

The most successful financial services websites don’t just meet E-E-A-T standards; they exceed them by genuinely prioritising user needs, demonstrating real expertise, and building trust through transparency and consistent delivery of value.

Key Takeaways

- Make people-first content: Every piece of content should answer the fundamental questions of who created it, how it was created, and why users should trust it. Focus on serving user needs rather than manipulating search rankings.

- Operationalise your expert review process: Develop clear workflows for content creation, review, and updating that involve appropriately qualified professionals at every stage. Document these processes both for compliance and credibility.

- Show real experience through practical examples: Generic advice is everywhere; specific, experience-based insights are rare and valuable. Share case studies, process documentation, and behind-the-scenes insights that only genuine practitioners can provide.

- Be radically transparent: Publish clear policies, complaints procedures, fee structures, and risk information. Make it easy for customers to contact you and understand exactly what they’re getting into.

- Reinforce with technical excellence: Support your content quality with strong technical foundations, schema markup, clear site architecture, excellent performance, and robust security implementations.

- Measure and iterate: Implement regular review cycles, track meaningful metrics, and continuously improve based on performance data and industry changes.

Ready to Make Trust a Ranking Advantage?

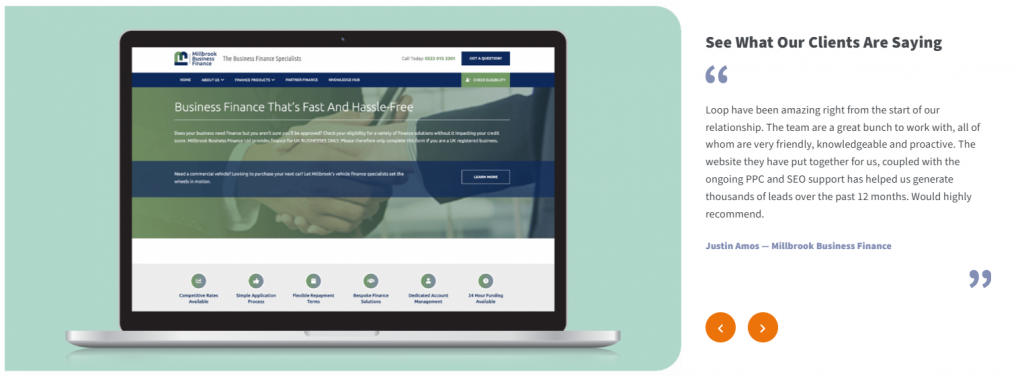

Building strong E-E-A-T signals for financial services requires specialist knowledge of both the industry and search best practices. At Loop Digital, we understand the unique challenges facing UK financial services businesses, from FCA compliance requirements to the technical complexities of YMYL content optimisation.

As a dedicated finance digital marketing agency in the UK, we focus on helping financial firms build credibility, improve lead generation, and future-proof their online presence.

We offer comprehensive SEO audits that identify quick wins and long-term opportunities, content governance frameworks that align with compliance requirements, schema deployment that reinforces your expertise signals, PR strategies that build genuine authority, and conversion rate optimisation specifically for trust-critical pages.

Get a tailored SEO and content audit to review your E-E-A-T & YMYL optimisation of your financial site by filling in our quick form, and we’ll outline specific quick wins for your financial services website within just 24 hours.

If you’d prefer a more personal approach, then book a free 30-minute consultation to discuss your questions about FCA-aware SEO and discuss your unique business needs and challenges directly with our team.

Frequently Asked Questions

1. Why is it important to regulate the financial sector?

Financial services regulation exists primarily to protect consumers from harm and maintain stability in the financial system. When it comes to online content, regulation ensures that financial information is accurate, fair, and not misleading, which directly aligns with Google’s E-E-A-T expectations for YMYL content.

Poor or misleading financial advice can cause serious harm to individuals and families. Regulation provides standards for qualifications, conduct, and communication that help ensure consumers receive reliable information.

2. How often should financial content be reviewed and updated for E-E-A-T?

We recommend a quarterly review cycle for key YMYL content, with more frequent updates for time-sensitive information like interest rates, regulatory changes, or market conditions.

Your review process should include checking factual accuracy against current regulations and market conditions, updating examples and case studies to reflect recent experience, reviewing author bios and credentials for currency, and ensuring contact information and policies remain accurate.

Make these reviews visible to users through “last reviewed” dates and change logs, as this demonstrates ongoing engagement with your content.

3. Why do FCA compliance and digital marketing align under E-E-A-T?

The alignment between FCA compliance and E-E-A-T is remarkably strong because both frameworks prioritise user welfare and information quality.

FCA’s core principle of treating customers fairly requires communications that are “fair, clear, and not misleading” which is essentially Google’s definition of helpful content applied to financial services. Compliance workflows that involve expert review, regular updates, and clear documentation also create the paper trail that demonstrates E-E-A-T to search engines.

4. What metrics can measure the success of E-E-A-T SEO in finance?

Effective E-E-A-T measurement combines traditional SEO metrics with trust and authority indicators:

- Search performance: Track visibility for branded queries, industry expertise terms, and YMYL keywords. Growing organic traffic from high-intent financial queries often indicates improving E-E-A-T signals.

- Authority indicators: Monitor the quality and quantity of referring domains, mentions in trade publications, and citations of your content by other authoritative sources.

- Content quality metrics: Measure the percentage of pages with author bios, expert review stamps, and recent update dates. Track time on the page and scroll depth for key YMYL content.

- Conversion and trust metrics: Monitor conversion rates on product pages, contact form submissions, and consultation bookings. Strong E-E-A-T signals should reduce friction in high-trust interactions.

Looking for your next opportunity?

Digital marketing careers

We’re always on the lookout for talented individuals to join our ever growing team. If you think you’d be a great match for Loop Digital, we’d love to hear from you.

Join 300+ business owners getting weekly growth strategies - subscribe now.

"*" indicates required fields